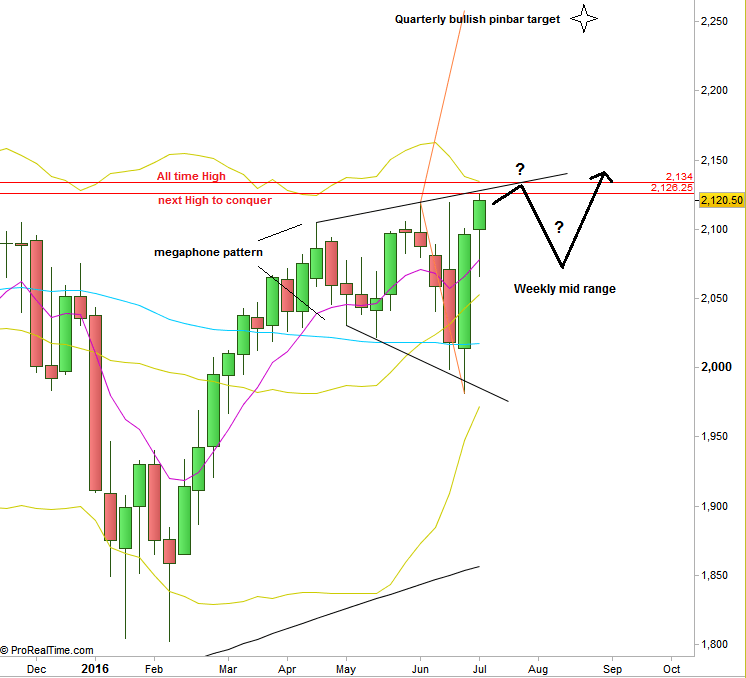

Two weeks after the Brexit pole, the market looks very strong, and currently is above the highest price prior to the pole.

At this point it might looks like as if nothing could stop the market from taking out the all time high and skyrocket into the Monthly upper Bollinger band at 2180, at least.

However, we have to realize two important things. First, although the market took out the Weekly swing High, it was made after making a LL first, so now we are in a megaphone pattern, mostly resolved after testing its mid range. Second, currently there isn’t any clear setup to go Long on the lower timeframes, except for the Quarterly and Semiannual bullish pinbars on a sloping 8 EMA, that last Friday daily bar made a thurst up above, hence triggered these setups for going Long to the 2250 (Quarterly) and 2400 (Semiannual) areas, BUT the stop is at the same scale, i.e. at least below the Quarterly Low at 1981.5. So these bullish setups are important to keep in mind knowing where the wind blows, but not for practical trading, at least not for a retail trader.

The last High prior to all time High at 2126.5 (July 2015) is less than 1 point above the last Friday’s High. There are many chances to see the price takes out that high, even right at the beginning of the week. Next, a clear reversal down below the All Time High should indicate that the market has time, and we should expect testing the Weekly midrange at least, at 2080. It would be good idea to look for bullish signals has the price declined again into the 2020 area where the Daily 200 SMA, the Weekly 50 SMA and the Quarterly 8 EMA currently reside.

Taking out the All Time High doesn’t necessarily mean that the big break up towards 2250 has started, as the current price action in the wide Monthly range may suggest one more Quarter (!) of sideways action before the real move upward starts.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.