US PRE MARKET

The S&P 500 Futures is trading at 2,687.50 with a loss of -0.20% percent or -5.50 point. Other U.S. stock futures lower in pre-market trading for Friday, April 20. The Dow Futures is trading at 24,568.00 with a loss of -0.28% percent or -69.00 point. The Nasdaq Futures is trading at 6,751.75 with a loss of -0.42% percent or -28.25 point.

FRIDAY’S FACTORS AND EVENTS

THURSDAY’S ACTIVITY

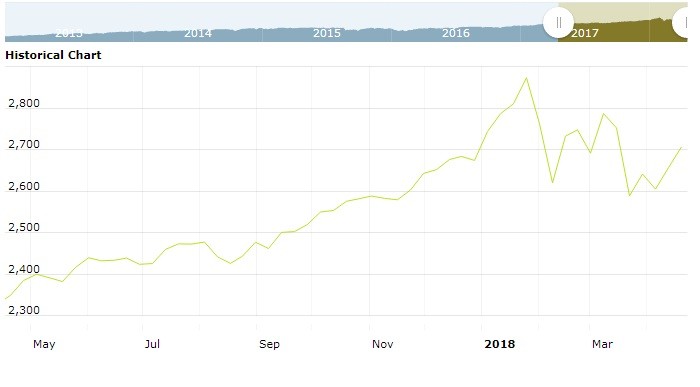

U.S. market were lower on Thursday. For the day the Dow Jones Industrial Average closed at 24,664.89 with a loss of -0.34% percent or −83.18 point. The S&P 500 closed at 2,693.13 with a loss of -0.57% percent or −15.51 point. The Nasdaq Composite closed at 7,238.06 with a loss of -0.78% percent or −57.18 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,573.82 with a loss of -0.62% percent or -9.74 point; the S&P 600 Small-Cap Index closed at 967.81 with a loss of -0.75% percent or −7.29 point; the S&P 400 Mid-Cap Index closed at 1,913.62 with a loss of -0.48% percent or −9.18 point; the S&P 100 Index closed at 1,181.89 with a loss of -0.45% percent or −5.37 point; the Russell 3000 Index closed at 1,597.25 with a loss of -0.57% percent or −9.21 point; the Russell 1000 Index closed at 1,493.45 with a loss of -0.57% percent or −8.56 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,162.24 with a loss of -0.13% percent or ?28.94 point. Hong Kong’s Hang Seng is trading at 30,477.26 with a loss of -0.74% percent or ?227.48 point. China’s Shanghai Composite is trading at 3,070.21 with a loss of -1.51% percent or ?46.99 point. India’s BSE Sensex is trading at 34,375.47 with a loss of -0.15% percent or -52.61 point at 12:15 PM.The FTSE 100 is trading at 7,354.23 up with 0.35% percent or +25.31 point. Germany’s DAX is trading at 12,557.96 with a loss of -0.075% percent or −9.46 point. France’s CAC 40 is trading at 5,389.41 with a loss of -0.041% percent or −2.23 point. The Stoxx Europe 600 is trading at 381.30 with a loss of -0.17% percent or -0.65 point.

Wall Street also kept an eye on rising interest rates, as the 10-year Treasury note yield broke above 2.9 percent. The 10-year traded around these levels earlier this year, sparking a correction in the U.S. stock market as investors feared the inflation was rising faster than expected. The move higher on the benchmark U.S. yield came as the two-year yield traded near highest levels in nearly a decade.

“The market is looking tired as yields may soon be a constraining factor that could overshadow good earnings,” said Peter Cardillo, chief market economist at Spartan Capital Securities.

Thursday’s dip came after the S&P 500 and Nasdaq posted slight gains on Wednesday, boosted by strong corporate earnings from United Airlines and CSX.