US PRE MARKET

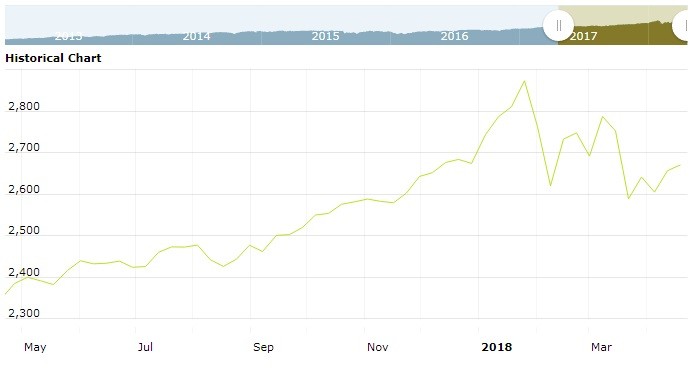

The S&P 500 Futures is trading at 2,669.00 with a loss of -0.09% percent or -2.50 point. Other U.S. stock futures lower in pre-market trading for Monday, April 23. The Dow Futures is trading at 24,395.00 with a loss of -0.16% percent or -38.00 point. The Nasdaq Futures is trading at 6,669.25 with a loss of -0.10% percent or -7.00 point.

MONDAY’S FACTORS AND EVENTS

FRIDAY’S ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,564.12 with a loss of -0.62% percent or -9.69 point; the S&P 600 Small-Cap Index closed at 961.76 with a loss of -0.63% percent or -6.05 point; the S&P 400 Mid-Cap Index closed at 1,900.50 with a loss of -0.69% percent or -13.12 point; the S&P 100 Index closed at 1,170.45 with a loss of -0.97% percent or -11.44 point; the Russell 3000 Index closed at 1,584.38 with a loss of -0.81% percent or −12.88 point; the Russell 1000 Index closed at 1,481.18 with a loss of -0.82% percent or −12.28 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,088.04 with a loss of -0.33% percent or -74.20 point. Hong Kong’s Hang Seng is trading at 30,315.84 with a loss of -0.34% percent or -102.49 point. China’s Shanghai Composite is trading at 3,065.72 with a loss of -0.19% percent or -5.82 point. India’s BSE Sensex is trading at 34,564.52 up with +0.43% percent or +148.94 point at 12:15 PM.The FTSE 100 is trading at 7,374.62 up with +0.083% percent or +5.38 point. Germany’s DAX is trading at 12,478.47 with a loss of -0.49% percent or −62.03 point. France’s CAC 40 is trading at 5,396.34 with a loss of -0.30% percent or −16.42 point. The Stoxx Europe 600 is trading at 380.79 with a loss of -0.28% percent or -1.08 point.

The two-year yield hit 2.461 percent, meanwhile, its highest level since Sept. 8, 2008, when the two-year yielded as high as 2.542 percent. Friday’s moves cap a week of rising rates accredited to geopolitical and trade tensions, rising commodity prices and an uptick in German bund yields.

As of the latest reading, the yield on the benchmark 10-year Treasury note was higher at around 2.96 percent at 3:52 p.m. ET, up roughly 10 basis points for the week. The yield on the 30-year Treasury bond was up at 3.146 percent, approximately 8 basis points higher since Monday. Bond yields move inversely to prices.