US PRE MARKET

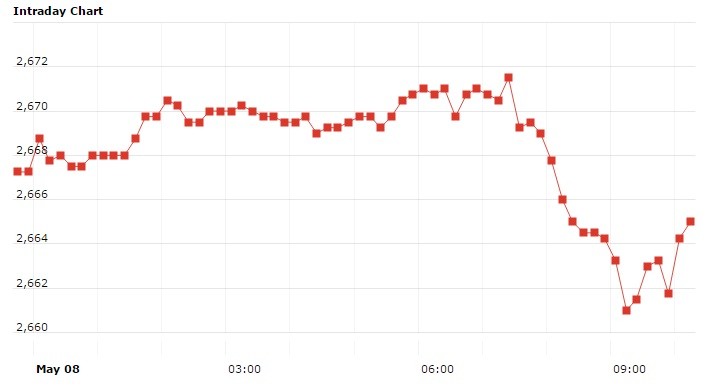

The S&P 500 Futures is trading at 2,662.75 with a loss of -0.27% percent or -7.25 point. Other U.S. stock futures lower in pre-market trading for Tuesday, May 08. The Dow Futures is trading at 24,246.00 with a loss of -0.27% percent or -65.00 point. The Nasdaq Futures is trading at 6,806.25 with a loss of -0.29% percent or -19.75 point.

TUESDAY’S FACTORS AND EVENTS

MONDAY’S ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,578.95 up with +0.85% percent or +13.34 point; the S&P 600 Small-Cap Index closed at 966.49 up with +0.79% percent or +7.57 point; the S&P 400 Mid-Cap Index closed at 1,907.92 up with +0.55% percent or +10.47 point; the S&P 100 Index closed at 1,174.26 up with +0.39% percent or +4.62 point; the Russell 3000 Index closed at 1,587.44 up with +0.42% percent or +6.68 point; the Russell 1000 Index closed at 1,483.10 up with +0.39% percent or +5.71 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,508.69 up with +0.18% percent or +41.53 point. Hong Kong’s Hang Seng is trading at 30,402.81 up with +1.36% percent or +408.55 point. China’s Shanghai Composite is trading at 3,161.50 up with +0.79% percent or +24.85 point. India’s BSE Sensex is trading at 35,221.50 up with +0.036% percent or +12.69 point at 12:15 PM.The FTSE 100 is trading at 7,576.11 up with +0.12% percent or +8.97 point. Germany’s DAX is trading at 12,888.85 with a loss of -0.46% percent or -59.29 point. France’s CAC 40 is trading at 5,507.36 with a loss of -0.43% percent or 23.84 point. The Stoxx Europe 600 is trading at 388.71 with a loss of -0.20% percent or -0.74 point.

U.S. stock index futures fluctuated ahead of Tuesday’s open, as markets around the world turned their attention to the U.S. administration and the future of the country’s involvement in the 2015 nuclear accord with Iran.

Around 4:20 a.m. ET, Dow futures slipped 21 points, indicating a lower open of 19.32 points. The Nasdaq and the S&P 500 futures indicated a relatively flat to lower start to the session for their respective markets.

The moves in pre-market trade come as global markets remain on edge, awaiting an announcement by President Donald Trump on the future of an international nuclear agreement.