US PRE MARKET

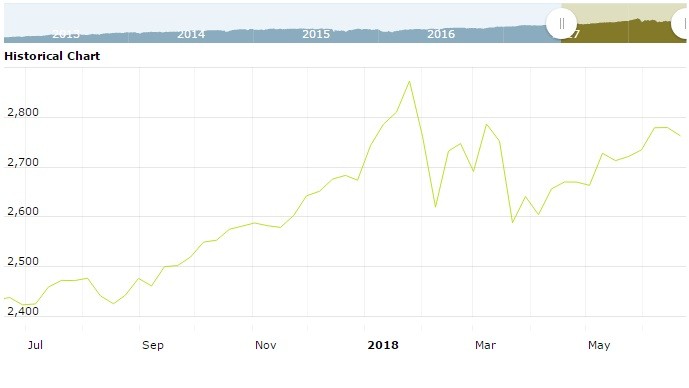

The S&P 500 Futures is trading at 2,764.25 up with +0.43% percent or +11.75 point. Other U.S. stock futures higher in pre-market trading for Thursday, June 22. The Dow Futures is trading at 24,570.00 up with +0.40% percent or +98.00 point. The Nasdaq Futures is trading at 7,262.75 up with +0.35% percent or +25.00 point.

FRIDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,688.95 with a loss of -1.06% percent or -18.04 point; the S&P 600 Small-Cap Index closed at 1,042.41 with a loss of -0.95% percent or -9.99 point; the S&P 400 Mid-Cap Index closed at 1,987.34 with a loss of -0.72% percent or -14.45 point; the S&P 100 Index closed at 1,207.08 with a loss of -0.68% percent or -8.21 point; the Russell 3000 Index closed at

1,640.93 with a loss of -0.70% percent or -11.51 point; the Russell 1000 Index closed at 1,528.58 with a loss of -0.66% percent or -10.23 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere,, Japan’s Nikkei 225 is trading at 22,516.83 with a loss of -0.78% percent or -176.21 point. Hong Kong’s Hang Seng is trading at 29,357.77 up with +0.21% percent or +61.72 point. China’s Shanghai Composite is trading at 2,889.76 up with +0.49% percent or +13.95 point. India’s BSE Sensex is trading at 35,507.72 up with +0.21% percent or +75.33 point at 12:15 PM.The FTSE 100 is trading at 7,620.92 up with +0.85% percent or +64.48 point. Germany’s DAX is trading at 12,564.21 up with +0.42% percent or +52.30 point. France’s CAC 40 is trading at 5,357.36 up with +0.78% percent or +41.35 point. The Stoxx Europe 600 is trading at 383.57 up with +0.72% percent or +2.73 point.

As another trading week draws to a close, market-watchers will likely be awaiting news coming out of the political, economic and commodity spheres. Markets around the globe have been on a roller-coaster ride this week as tensions surrounding a tit-for-tat trade dispute between the U.S. and China continue to escalate.

On Monday, President Donald Trump requested the United States Trade Representative identify $200 billion worth of Chinese goods for additional tariffs at a rate of 10 percent. Those tariffs followed levies announced by both nations last week. Consequently, Beijing stated that it would deliver its own set of counter measures, if required.

THURSDAY’S ACTIVITY