US PRE MARKET

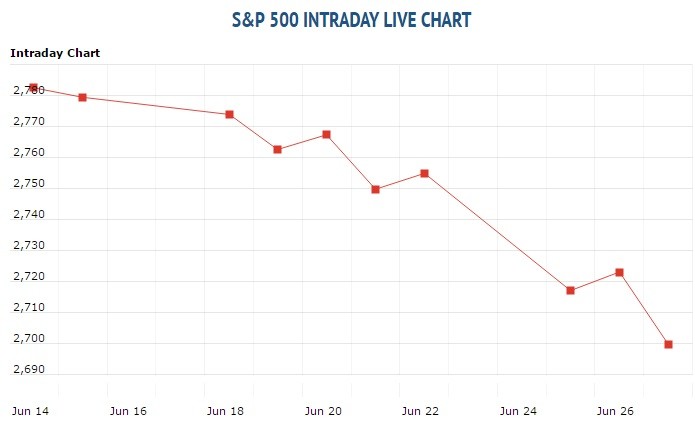

The S&P 500 Futures is trading at 2,710.50 up with +0.20% percent or +5.50 point.Other U.S. stock futures higher in pre-market trading for Thursday, June 28. The Dow Futures is trading at 24,177.00 up with +0.17% percent or +42.00 point. The Nasdaq Futures is trading at 7,013.25 up with +0.21% percent or +20.00 point.

THURSDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,640.45 with a loss of -1.68% percent or -28.07 point; the S&P 600 Small-Cap Index closed at 1,017.36 with a loss of -1.54% percent or -15.95 point; the S&P 400 Mid-Cap Index closed at 1,942.81 with a loss of -1.13% percent or -22.30 point; the S&P 100 Index closed at 1,185.25 with a loss of -0.83% percent or -9.89 point; the Russell 3000 Index closed at 1,608.39 with a loss of -0.97% percent or -15.70 point; the Russell 1000 Index closed at 1,499.44 with a loss of -0.91% percent or -13.70 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 22,270.39 with a loss of – 0.0062% percent or -1.38 point. Hong Kong’s Hang Seng is trading at 28,468.11 up with + 0.39% percent or +111.51 point. China’s Shanghai Composite is trading at 2,786.90 with a loss of -0.93% percent or -26.28 point. India’s BSE Sensex is trading at 35,139.80 with a loss of -0.22% percent or -77.31 point at 12:15 PM.The FTSE 100 is trading at 7,607.55 with a loss of -0.19% percent or -14.45 point. Germany’s DAX is trading at 12,268.27 with a loss of -0.65% percent or -80.34 point. France’s CAC 40 is trading at 5,310.79 with a loss of -0.31% percent or -16.41 point. The Stoxx Europe 600 is trading at 378.14 with a loss of -0.49% percent or –0.53 point.

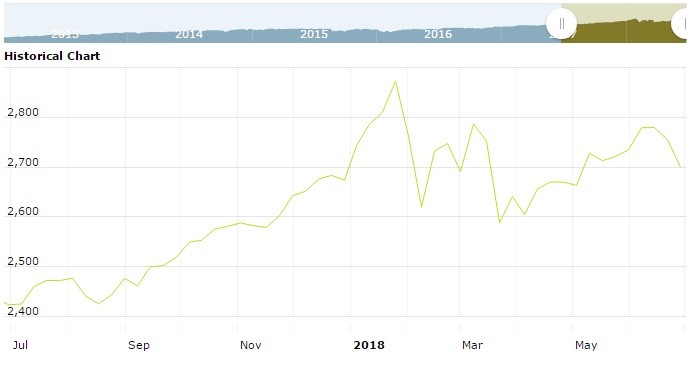

As anticipated, fears surrounding a potential trade war between the U.S. and other major economies continue to plague market sentiment. Not only is the U.S. in a tit-for-tat war of words with China on tariffs, but now the European Union is involved, after President Donald Trump took to Twitter last week to threaten a 20 percent tariff on all car imports from the bloc.

Economic data will be keeping market-watchers engaged Thursday, with the real gross domestic product (GDP) data due out at 8:30 a.m. ET, jobless claims also due at 8:30 a.m. ET, and the Kansas City Fed’s manufacturing survey at 11 a.m. ET.

WEDNESDAY’S ACTIVITY