US PRE MARKET

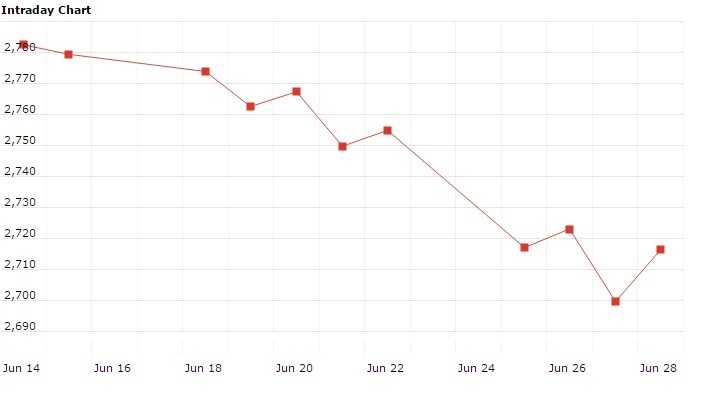

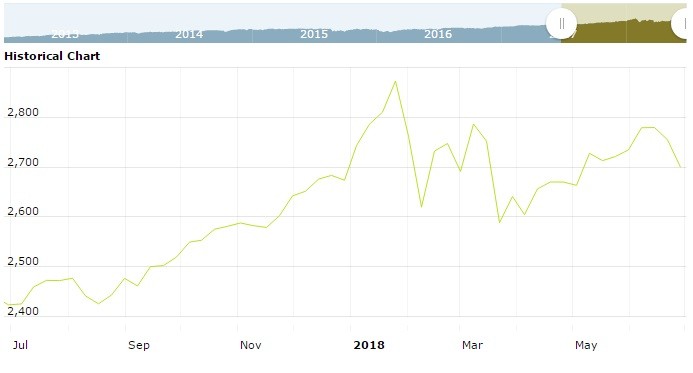

The S&P 500 Futures is trading at 2,726.75 up with +0.35% percent or +9.50 point.Other U.S. stock futures higher in pre-market trading for Friday, June 29. The Dow Futures is trading at 24,309.00 up with +0.37% percent or +89.00 point. The Nasdaq Futures is trading at 7,089.50 up with +0.41% percent or +29.00 point.

FRIDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,645.02 up with +0.28% percent or +4.56 point; the S&P 600 Small-Cap Index closed at 1,020.22 up with +0.28% percent or +2.86 point; the S&P 400 Mid-Cap Index closed at 1,950.37 up with +0.39% percent or +7.56 point; the S&P 100 Index closed at 1,194.20 up with +0.76% percent or +8.95 point; the Russell 3000 Index closed at 1,617.96 up with +0.60%percent or +9.57 point; the Russell 1000 Index closed at 1,508.77 up with +0.62% percent or +9.33 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 22,304.51 up with +0.15% percent or +34.12 point. Hong Kong’s Hang Seng is trading at 28,945.98 up with + 1.57% percent or +448.66 point. China’s Shanghai Composite is trading at 2,847.42 up with +2.17% percent or +60.52 point. India’s BSE Sensex is trading at 35,332.13 up with +0.84% percent or +294.49 point at 12:15 PM.The FTSE 100 is trading at 7,664.80 up with +0.65 percent or +49.17 point. Germany’s DAX is trading at 12,293.61 up with +0.96% percent or +116.38 point. France’s CAC 40 is trading at 5,330.42 up with +1.04% percent or +54.78 point. The Stoxx Europe 600 is trading at 380.03 up with +0.84% percent or +3.22 point.

Market focus is largely attuned to concerns over global trade, a week before initial U.S. and Chinese tariffs are due to take effect. President Donald Trump’s administration is set to activate tariffs on Chinese goods worth around $34 billion on July 6, which is then widely expected to trigger a tit-for-tat response from Beijing.

The escalating trade dispute between the U.S. and other major economies also cast doubt on future crude demand growth, with oil prices mixed on Friday morning. International benchmark Brent crude traded at $78.25 a barrel during early morning deals, up 0.5 percent, while U.S. WTI stood at $73.32 a barrel, down around 0.2 percent.

On the data front, personal income data for May is scheduled to be released at around 8.30 a.m. ET, with a final reading of consumer sentiment data for June due later in the session.

THURSDAU’S ACTIVITY