US PRE MARKET

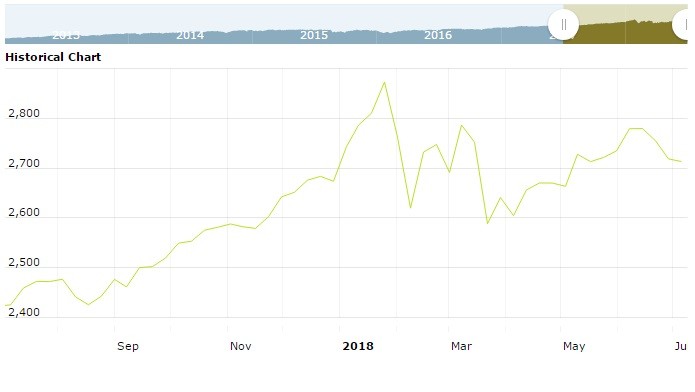

The S&P 500 Futures is trading at 2,725.00 up with +0.30% percent or +0.43% point. Other U.S. stock futures higher in pre-market trading for Wednesday, July 04. The Dow Futures is trading at 24,244.00 up with +0.34% percent or +81.00 point.The Nasdaq Futures is trading at 7,051.00 up with +0.39% percent or +27.25 point.

THURSDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,660.42 up with +0.32% percent or +5.33 point; the S&P 600 Small-Cap Index closed at 1,028.93 up with +0.16% percent or +1.65 point; the S&P 400 Mid-Cap Index closed at 1,957.35 up with +0.19% percent or +3.70 point; the S&P 100 Index closed at 1,191.76 with a loss of -0.64% percent or -7.70 point; the Russell 3000 Index closed at 1,618.04 with a loss of -0.39% percent or – 6.35 point; the Russell 1000 Index closed at 1,507.65 with a loss of -0.45% percent or -6.84 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 21,546.99 with a loss of -0.78% percent or -170.05 point. Hong Kong’s Hang Seng is trading at 27,933.90 with a loss of -1.09% percent or -307.77 point. China’s Shanghai Composite is trading at 2,731.43 with a loss of -1.00% percent or -27.70 point. India’s BSE Sensex is trading at 35,563.48 with a loss of -0.23% percent or -81.92 point at 12:15 PM.The FTSE 100 is trading at 7,603.45 up with +0.40% percent or +30.36 point. Germany’s DAX is trading at 12,442.89 up with +1.04% percent or +128.09 point. France’s CAC 40 is trading at 5,362.80 up with +0.80% percent or +42.31 point. The Stoxx Europe 600 is trading at 381.89 up with +0.48% percent or +1.92 point.

As markets open back up after Independence Day, bond investors in the States are likely to be turning their attention to news coming out of the U.S. central banking space. At 2 p.m., the Federal Open Market Committee is expected to publish the minutes from its latest central banking meeting, which took place in June.

At the last meeting, the Fed decided to increase its benchmark short-term interest rate by a quarter percentage point. In addition, the central bank signaled that two more rate hikes were expected to occur by year-end.

Investors will be looking over today’s minutes release, to see if the central bank provides any more information on the state of the U.S. economy and the Fed’s rate path.

WEDNESDAY’S ACTIVITY