US PRE MARKET

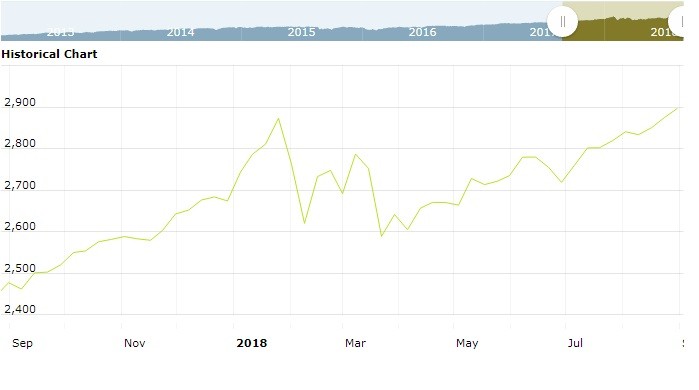

The S&P 500 Futures is trading at 2,899.25 with 0.00% percent or 0.00 point. Other U.S. stock futures mixed in pre-market trading for August 29. The Dow Futures is trading at 26,073.00 with a loss of -0.05% percent or -12.00 point. The Nasdaq Futures is trading at 7,589.25 up with +0.15% percent or +11.00 point.

WEDNESDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,728.42 up with +0.00091% percent or +0.016 point; the S&P 600 Small-Cap Index closed at 1,092.64 with a loss of -0.029% percent or -0.32 point; the S&P 400 Mid-Cap Index closed at 2,043.94 with a loss of -0.0059% percent or -0.12 point; the S&P 100 Index closed at 1,283.24 with a loss of -0.016% percent or -0.21 point; the Russell 3000 Index closed at 1,722.84 up with +0.041% percent or +0.71 point; the Russell 1000 Index closed at 1,608.36 up with +0.045% percent or +0.72 point;

WORLD MARKETS

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 22,848.22 up with +0.15% percent or +34.75 point. Hong Kong’s Hang Seng is trading at 28,325.33 with a loss of -0.093% percent or -26.29 point. China’s Shanghai Composite is trading at 2,767.04 with a loss of -0.39% percent or -10.94 point. India’s BSE Sensex is trading at 38,883.18 with a loss of -0.035% percent or -13.45 point at 12:15 PM.The FTSE 100 is trading at 7,589.10 with a loss of -0.37% percent or -28.12 point. Germany’s DAX is trading at 12,520.74 with a loss of -0.053% percent or -6.68 point. France’s CAC 40 is trading at 5,485.95 up with +0.018% percent or +0.96 point. The Stoxx Europe 600 is trading at 385.49 up with +0.01% percent or +0.03 point.

U.S. government debt prices ticked higher on Wednesday.

Mortgage applications are due out at 7 a.m. ET, with pending home sales figures for July due out at 10 a.m. ET. A vital piece of information that is likely to shake up markets Wednesday is the second estimate for the second quarter’s gross domestic product (GDP) data, which is due out at 8:30 a.m. ET.

On the auctions front, the U.S. Treasury is scheduled to auction $31 billion in seven-year notes and $17 billion in two-year floating rate notes (FRNs). No sizes of impending auctions are set to be announced.

TUESDAY’S ACTIVITY