US PRE MARKET

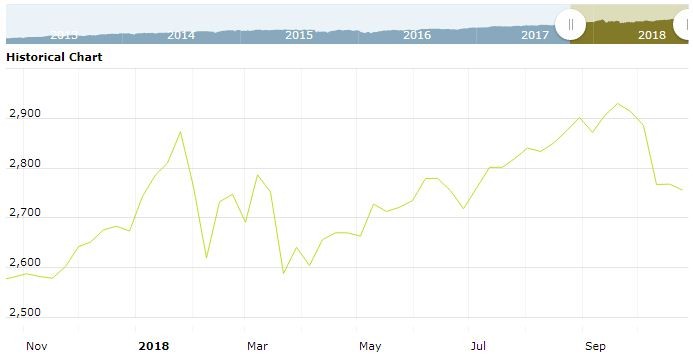

The S&P 500 Futures is trading at 2,730.50 with a loss of -0.57% percent or -15.75 point. Other U.S. stock futures lower in pre-market trading for October 24.The Dow Futures is trading at 25,114.00 with a loss of -0.46% percent or -116.00 point. The Nasdaq Futures is trading at 7,090.00 with a loss of -0.70% percent or -50.25 point.

WEDNESDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,526.59 with a loss of -0.84% percent or -12.91 point; the S&P 600 Small-Cap Index closed at 954.45 with a loss of -0.78% percent or -7.49 point; the S&P 400 Mid-Cap Index closed at 1,844.73 with a loss of -0.99% percent or -18.42 point; the S&P 100 Index closed at 1,225.82 with a loss of -0.42% percent or -5.20 point; the Russell 3000 Index closed at 1,614.03 with a loss of -0.58% percent or -9.36 point; the Russell 1000 Index closed at 1,513.98 with a loss of -0.56% percent or -8.46 point;

In overnight trading in the Eastern Hemisphere, apan’s Nikkei 225 is trading at 22,091.18 with a loss of -0.37% percent or -80.40 point. Hong Kong’s Hang Seng is trading at 25,238.66 with a loss of -0.43% percent or -107.89 point. China’s Shanghai Composite is trading at 2,603.42 up with +0.33% percent or +8.59 point. India’s BSE Sensex is trading at 33,997.93 up with +0.45% percent or +150.70 point at 12:15 PM.The FTSE 100 is trading at 7,010.78 with a loss of -0.80% percent or -55.57 point. Germany’s DAX is trading at 11,314.40 up with +0.36% percent or +40.12 point. France’s CAC 40 is trading at 5,009.43 up with +0.84% percent or +41.74 point. The Stoxx Europe 600 is trading at 356.20 up with +0.61% percent or +2.16 point.

A general risk-off move in global stock markets has seen investors move into the relative safety of government bonds and precious metals like gold. U.S. stock index futures indicated a weak start to the trading day Wednesday, with Dow futures pointing to triple-digit losses.

Investors are keeping an eye on a number of data points expected on Wednesday morning. At 7 a.m. ET, MBA mortgage applications are expected, followed by the FHFA House Price Index at 9 a.m. ET, a PMI composite flash at 9:45 a.m. ET, new home sales numbers at 10 a.m. ET and the Beige Book at 2 p.m. ET.

TUESDAY’S ACTIVITY