US PRE MARKET

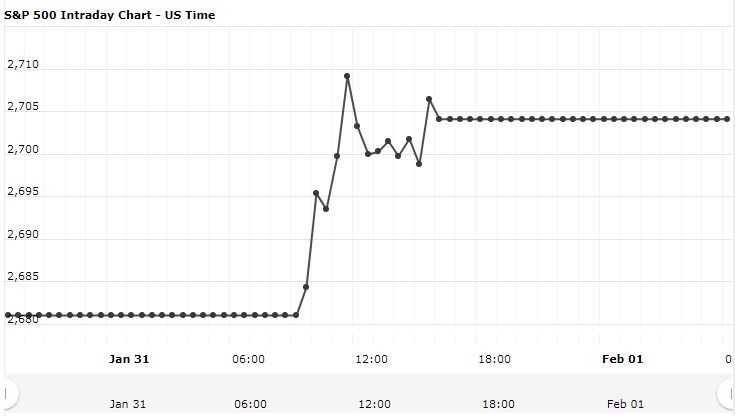

The S&P 500 Futures is trading at 2,702.12 with a loss of -0.09% percent or -2.38 point. Other U.S. stock futures mixed in pre-market trading for February 01.The Dow Futures is trading at 24,985.50 up with +0.04% percent or +9.50 point. The Nasdaq Futures is trading at 6,882.00 with a loss of -0.47% percent or -32.75 point.

FRIDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,499.42 up with +0.84% percent or +12.48 point; the S&P 600 Small-Cap Index closed at 934.12 up with +0.85% percent or +7.83 point; the S&P 400 Mid-Cap Index closed at 1,835.39 up with +0.45% percent or +8.18 point; the S&P 100 Index closed at 1,191.68 up with +0.94% percent or +11.12 point; the Russell 3000 Index closed at 1,596.54 up with +0.85% percent or +13.50 point; the Russell 1000 Index closed at 1,596.54 up with +0.85% percent or +13.50 point

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 20,788.39 up with +0.072% percent or +14.90 point. Hong Kong’s Hang Seng is trading at 20,788.39 up with +0.072% percent or +14.90 point. China’s Shanghai Composite is trading at 2,618.23 up with +1.30% percent or +33.66 point. India’s BSE Sensex is trading at 36,680.08 up with +1.17% percent or +423.39 point at 12:15 PM.The FTSE 100 is trading at 7,016.43 UP with +0.68% percent or +47.58 point. Germany’s DAX is trading at 11,154.47 with a loss of -0.17% percent or -18.63 point. France’s CAC 40 is trading at 4,997.18 up with +0.089% percent or +4.46 point. The Stoxx Europe 600 is trading at 358.85 UP with +0.05% percent or +0.19 point.

Investors are keen to know the latest nonfarm payroll figures, due out at 8:30 a.m. ET. The number is particularly important for the Federal Reserve and the direction of its monetary policy.

The central bank said Wednesday that it would be “patient ” with further interest rate hikes, signaling a potential end to its tightening cycle amid signs of a possible economic downturn.

THURSDAY’S ACTIVITY