US PRE MARKET

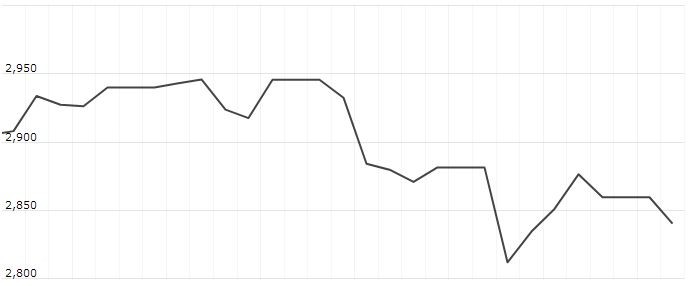

The S&P 500 Futures is trading at 2,861.12 up with +0.60% percent or +17.12 point.Other U.S. stock futures higher in pre-market trading for May 21. The Dow Futures is trading at 25,836.50 up with +0.55% percent or +140.50 point.The Nasdaq Futures is trading at 7,461.50 up with +0.94% percent or +69.75 point.

TUESDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,524.96 with a loss of -0.70% percent or -10.80 point; the S&P 600 Small-Cap Index closed at 928.23 with a loss of -0.68% percent or -6.33 point; the S&P 400 Mid-Cap Index closed at 1,875.69 with a loss of -0.73% percent or -13.71 point; the S&P 100 Index closed at 1,258.85 with a loss of -0.68% percent or -8.56 point; the Russell 3000 Index closed at 1,672.09 with a loss of -0.70% percent or -11.84 point; the Russell 1000 Index closed at 1,572.77 with a loss of -0.70% or -11.13 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,272.45 with a loss of -0.14% percent or -29.28 point. Hong Kong’s Hang Seng is trading at 27,753.00 with a loss of -0.12% percent or -34.61 point. China’s Shanghai Composite is trading at 2,907.55 up with +1.29% percent or +36.94 point. India’s BSE Sensex is trading at 39,407.05 up with +0.14% percent or +54.38 point at 12:15 PM.The FTSE 100 is trading at 7,363.02 up with +0.71% percent or +52.14 point. Germany’s DAX is trading at 12,175.16 up with +1.11% percent or +133.87 point. France’s CAC 40 is trading at 5,393.13 up with +0.64% percent or +34.55 point. The Stoxx Europe 600 is trading at 380.10 up with +0.69% percent or +2.64 point.

The speeches come after Fed Chairman Jerome Powell said Monday that rising levels of corporate debt did not pose an immediate threat to the financial system.

The issue of corporate debt has surfaced as companies continue to use the low rates the Fed has provided to lever up their balance sheets.

On the data front, the Philadelphia Fed non-manufacturing survey for May is set to come out at around 8:30 a.m. ET, followed by existing home sales figures for April at around 10:00 a.m. ET.

Meanwhile, the U.S. Treasury is set to auction $26 billion in 52-week bills on Tuesday.

In commodity markets, oil prices were slightly higher as energy market participants monitored escalating U.S.-Iran tensions.

MONDAY’S ACTIVITY

For the day the Dow is trading at 25,679.90 with a loss of -0.33% percent or -84.10 point. The S&P 500 is trading at 2,840.23 with a loss of -0.67% percent or -19.30 point. The Nasdaq Composite is trading at 7,702.38 with a loss of -1.46% percent or -113.91 point.