US PRE MARKET

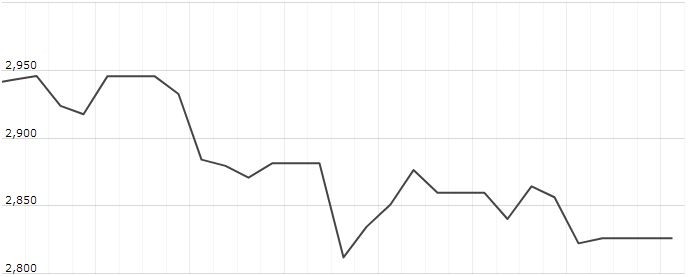

The S&P 500 Futures is trading at 2,789.62 with a loss of -0.55% percent or -15.38 point. Other U.S. stock futures lower in pre-market trading for May 29.The Dow Futures is trading at 25,221.50 with a loss of -0.58% percent or -147.50 point. The Nasdaq Futures is trading at 7,238.75 with a loss of -0.77% percent or -0.77% point.

WEDNESDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,504.02 with a loss of -0.67% percent or -10.09 point; the S&P 600 Small-Cap Index closed at 911.79 with a loss of -0.63% percent or -5.75 point; the S&P 400 Mid-Cap Index closed at 1,844.17 with a loss of -1.00% percent or -18.66 point; the S&P 100 Index closed at 1,240.99 with a loss of -0.77% percent or -9.68 point; the Russell 3000 Index closed at 1,649.75 with a loss of -0.82% percent or -13.60 point; the Russell 1000 Index closed at 1,551.81 with a loss of -0.83% or -12.97 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,003.37 with a loss of -1.21% percent or -256.77 point. Hong Kong’s Hang Seng is trading at 27,261.43 with a loss of -0.47% percent or -129.38 point. China’s Shanghai Composite is trading at 2,914.70 up with +0.16% percent or +4.79 point. India’s BSE Sensex is trading at 39,653.87 with a loss of -0.24% percent or -95.86 point at 12:15 PM.The FTSE 100 is trading at 7,176.12 with a loss of -1.28% percent or -92.76 point. Germany’s DAX is trading at 11,887.38 with a loss of -1.16% percent or -139.67 point. France’s CAC 40 is trading at 5,228.59 with a loss of -1.58% percent or -84.10 point. The Stoxx Europe 600 is trading at 371.14 with a loss of -1.27% percent or -4.76 point.

Treasury yields have had a big move lower this month, with the 10-year Treasury yielding at its lowest level since September 2017 in the previous session.

The move comes at a time when trade war fears have intensified and economic data has disappointed. The U.S. benchmark is also following Europe’s German 10-year bund yield, moving lower amid political and economic concerns.

On the data front, the Richmond Fed manufacturing survey for May is expected at around 10:00 a.m. ET, with Dallas Fed services data set to follow slightly later in the session.

Meanwhile, the U.S. Treasury is set to auction $32 billion in 7-year notes and $18 billion in 1-year-and-11-month floating rate notes (FRNs).

In commodity markets, oil prices fell 1% Wednesday amid concerns an ongoing trade war could spark a global economic downturn. But, relatively tight supply amid OPEC-led supply cuts and political tensions in the Middle East limited losses.

TUESDAY’S ACTIVITY

For the day the Dow is trading at 25,347.77 with a loss of -0.93% percent or -237.92 point. The S&P 500 is trading at 2,802.39 with a loss of -0.84% percent or -23.67 point. The Nasdaq Composite is trading at 7,607.35 with a loss of -0.39% percent or -29.66 point.