US PRE MARKET

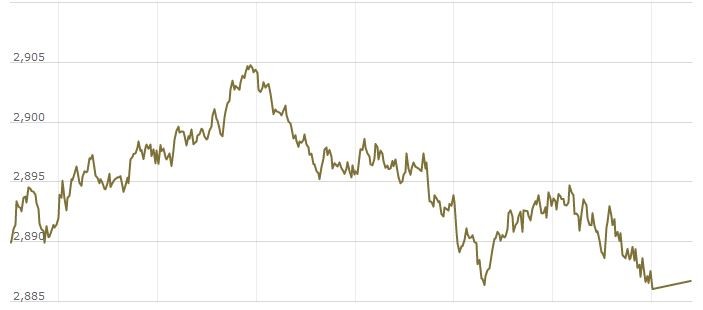

The S&P 500 Futures is trading at 2,902.38 up with +0.45% percent or +13.13 point. Other U.S. stock futures higher in pre-market trading for June 11. The Dow Futures is trading at 26,198.50 up with +0.43% percent or +112.50 point.The Nasdaq Futures is trading at 7,565.00 up with +0.66% percent or +49.50 point.

TUESDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,523.56 up with +0.61% percent or +9.17 point; the S&P 600 Small-Cap Index closed at 926.60 up with +0.73% percent or +6.71 point; the S&P 400 Mid-Cap Index closed at 1,902.19 up with +0.54% percent or +10.19 point; the S&P 100 Index closed at 1,272.58 up with +0.55% percent or +6.93 point; the Russell 3000 Index closed at 1,697.87 up with +0.50% percent or +8.43 point; the Russell 1000 Index closed at 1,598.94 up with +0.49% or +7.82 point.

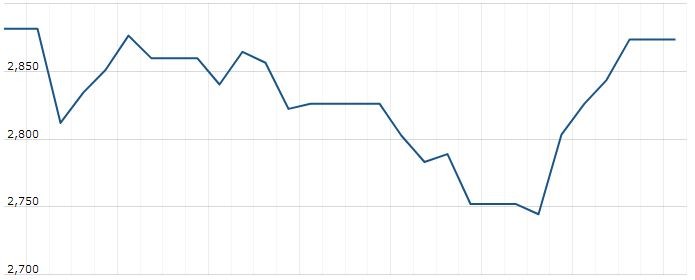

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,134.42 up with +1.20% percent or +249.71 point. Hong Kong’s Hang Seng is trading at 27,531.86 up with +2.10% percent or +566.58 point. China’s Shanghai Composite is trading at 2,852.13 up with +0.86% percent or +24.33 point. India’s BSE Sensex is trading at 39,670.32 up with +0.14% percent or +54.42 point at 12:15 PM.The FTSE 100 is trading at 7,403.23 up with +0.38% percent or +27.69 point. Germany’s DAX is trading at 12,198.32 up with +1.27% percent or +152.94 point. France’s CAC 40 is trading at 5,424.24 up with +0.78% percent or +41.75 point. The Stoxx Europe 600 is trading at 381.52 up with +0.86% percent or +3.25 point.

U.S. Treasury Secretary Steven Mnuchin disputed that interpretation in an interview with CNBC on Monday.

Mnuchin said falling bond yields, rather than warning of a recession, should be viewed as a sign that the Federal Reserve would cut interest rates over the coming months.

Bond yields fell to 20-month lows last week after government data showed U.S. job creation slowed more than expected in May.

Investor expectations of a June rate cut from the Fed rose last week to 27.5%, according to the CME Group’s FedWatch tool. The market gives a 79% chance of a Fed rate cut in July.

MONDAY’S ACTIVITY

For the day the Dow is trading at 26,062.68 up with +0.30% percent or +78.74 point. The S&P 500 is trading at 2,886.73 up with +0.47% percent or +13.39 point. The Nasdaq Composite is trading at 7,823.17 up with +1.05% percent or +81.07 point.