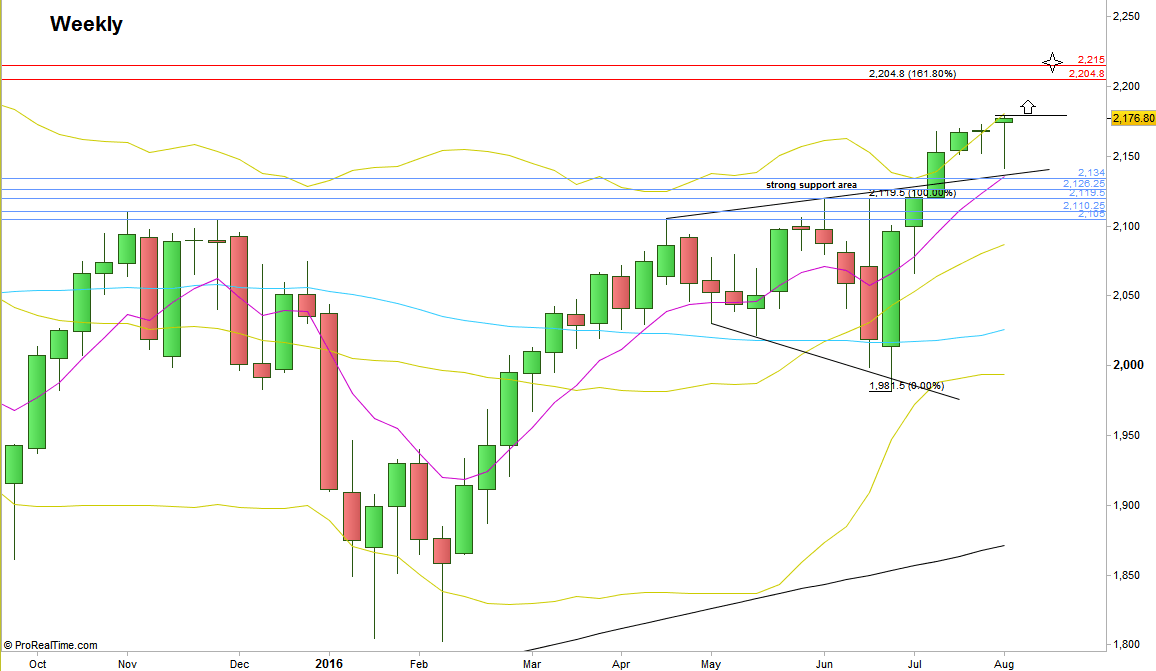

The last 3 Weeks were wonderful example to how market manipulation can take you off course, as twice the market gave you a buy signal by taking out the Weekly high, and twice this breaking up of the Weekly High turned out to be a false thrust, just to see it reverses again after extending downward, turning back into the range and recreate the same bullish signal again. The passing week printed a bullish Weekly pinbar leaning on the Weekly megaphone pattern described in previous reviews.

Currently, the market has the same potential bullish trigger again. Taking out the Weekly High is a signal to go Long with the same Weekly amplitude as a target, i.e. 2215, slightly above the 161.8% extension level of the Brexit reaction down, at 2204 (that should create some resistance and reaction – most likely).

This modus operandi leaves a Megaphone pattern on the chart, this time, an intraday timeframe pattern. Markets often resolve a megaphone pattern by testing again the mid range once more prior to the continuation of the original move.

In case the coming week starts by a new Weekly High, it might be better for some to wait for a pullback into the midrange followed by a clear reversal up in order to go Long with a stop below the Low created, or taking the break up with a stop below the Weekly Low for the others. In the former case, there is of course the risk that the market won’t go back into the midrange after taking out the Weekly High.

Otherwise (the market starts the week by testing the Weekly mid range ~ 2165), then the trigger to go long would be taking out the Weekly High, with a stop below the Low created in that testing of the midrange.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.