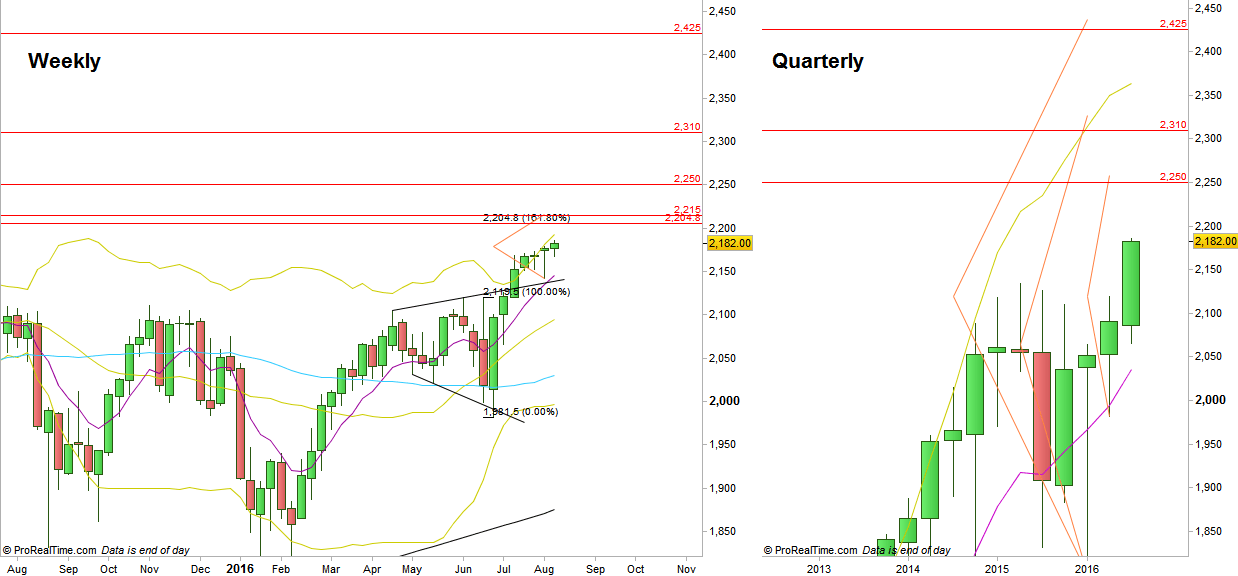

The passing week printed a narrow range Weekly bar with lower volume, very typical for August. After taking out the previous High, the price folded into the former range, just to reverse and continue the move higher. I mentioned this behavior of the Megaphone pattern in the last review.

The market has triggered the Weekly bullish pinbar of the former week, and the current target for this setup is 2215, slightly above the 161.8% extension level of the Brexit reaction down, at 2204.

Pay attention that on the longer timeframes, the market has two important Quarterly bullish pinbars on a sloping 8 EMA, the first Quarter of 2016 pinbar points to 2310, and second Quarter of 2016 pinbar points to 2250 (in fact it is the June Monthly pinbar which was the effective price action throughout the whole 2nd Quarter). Combining the two Quarterly pinbars would give us a Semiannual pinbar that points to 2425 approximately. Certainly, the stops are huge, and a retail trader can’t take advantage of this information as for his typical positions, but those pinbars may tell us to where this bullish market wants to go (at least to approach closer), prior to any consideration of a potential major shift in the market. So, every decline before reaching those targets must be considered to be a correction, not a beginning of a major shift in the market.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.