US PRE MARKET

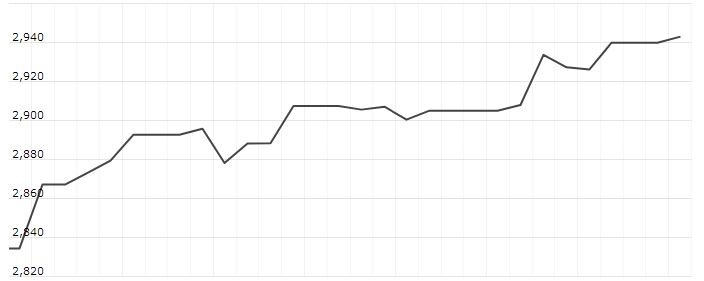

The S&P 500 Futures is trading at 2,927.25 up with +0.15% percent or +4.25 point. Other U.S. stock futures higher in pre-market trading for May 02.The Dow Futures is trading at 26,393.00 up with +3.00 percent or +55.70 point. The Nasdaq Futures is trading at 7,773.25 up with +0.22% percent or +16.75 point.

THURSDAY’S FACTORS AND EVENTS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,576.38 with a loss of –0.93% percent or –14.83 point; the S&P 600 Small-Cap Index closed at 966.76 with a loss of -0.85% percent or -8.30 point; the S&P 400 Mid-Cap Index closed at 1,948.87 with a loss of -1.11% percent or -21.87 point; the S&P 100 Index closed at 1,297.69 with a loss of -0.58% percent or -7.51 point; the Russell 3000 Index closed at 1,722.23 with a loss of -0.77% percent or -13.38 point; the Russell 1000 Index closed at 1,619.49 with a loss of -0.76% or -12.38 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 22,258.73 with a loss of -0.22% percent or -48.85 point. Hong Kong’s Hang Seng is trading at 29,957.91 up with +0.87% percent or +258.80 point. China’s Shanghai Composite is trading at 3,078.34 up with +0.52% percent or +15.84 point. India’s BSE Sensex is trading at 39,092.08 up with 0.16% percent or +60.53 point at 12:15 PM.The FTSE 100 is trading at 7,369.66 with a loss of -0.21% percent or -15.60 point. Germany’s DAX is trading at 12,345.68 up with 0.013% percent or +1.60 point. France’s CAC 40 is trading at 5,555.34 with a loss of -0.56% percent or -31.07 point. The Stoxx Europe 600 is trading at 389.42 with a loss -1.67 percent or –1.70 point.

The Federal Reserve surprised traders on Wednesday when curbing speculation that it could be getting ready for a rate cut. At the same time, the central bank also kept interest rates unchanged. Chairman Jerome Powell also said that the bank sees a decline in inflation as merely temporary and not yet a worrisome sign for the U.S. economy.

Thursday’s focus is on data with jobless claims due at 8:30 a.m. ET.

In terms of auctions, there is a sale of $50 billion in four-week bills and $35 billion in eight-week bills.

WEDNESDAY’S ACTIVITY

For the day the Dow is trading at 26,430.14 with a loss of -0.61% percent or -162.77 point. The S&P 500 is trading at 2,923.73 with a loss of -0.75% percent or -22.10 point. The Nasdaq Composite is trading at 8,049.64 wilth a loss of -0.57% percent or -45.75 point.