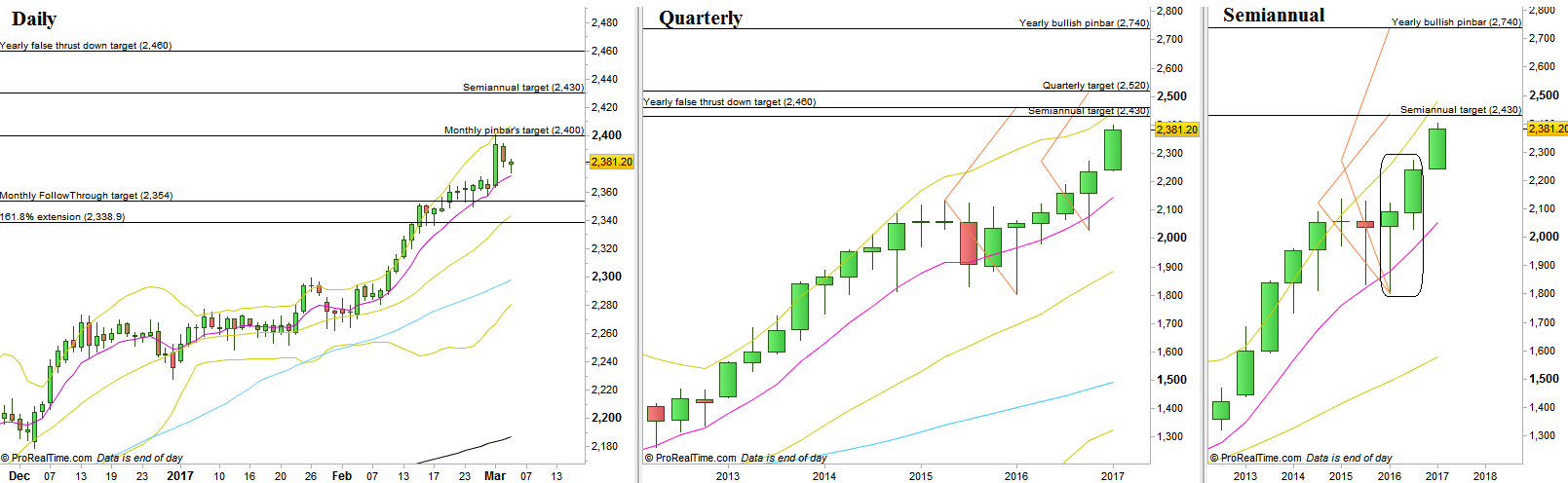

Another bullish week has brought the price to the 2400 target, a target marked for the Monthly spring bar of last November (US elections).

The market is pretty closed to the target of the Semiannual pinbar on sloping 8 EMA – of the first half of year 2016, at 2430.

Currently, nothing in the Daily and above timeframes show any sign of weakness. In such a behavior, and although there were major targets being achieved, it would be a mistake to enter short or focus on bearish setups. The attention should be focused on bearish setups that fail by ending as a new sign of strength. Every Daily pullback that ends with a sign of strength e.g. bullish pinbar or an Engulfing pattern should be watched for joining this strong momentum up.

Higher targets are the Yearly false break down, at 2460, the previous Quarterly bar which was a bullish pinbar on sloping 8 EMA, already got the a bullish pinbar on sloping 8 EMA, target at 2740.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.