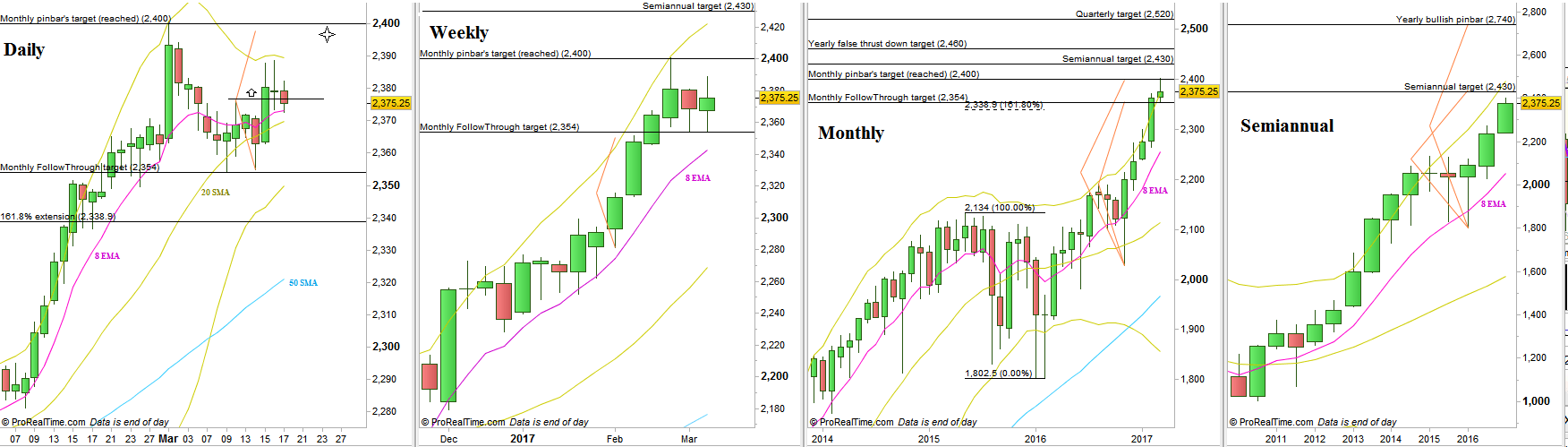

The passing week has turned the bearish sentiment of the former week into sideways action, closing as a HH HL Weekly bar.

The market is in a bullish setup to reach the upper side of the range, at 2398, created due to a failure of the bearish setup the market had set. The Daily bars of last Wednesday and Thursday made a thrust up, but withdrew before touching the upper band, a behavior that might point out that the market has time, and may test again the lower side of the range before continuing upwards. In this case, giving that the Weekly Low is NOT going to be taken out, it is recommended to watch for bullish signs at the area of 2362.5, that may push the price by the bullish setup back into the upper side of the range.

In the longer term picture, the market is closed to the target of the Semiannual Pinbar on sloping 8 EMA – of the first half of year 2016, at 2430.

Higher targets are the Yearly false break down, at 2460, the previous Quarterly bar which was a bullish Pinbar on sloping 8 EMA, already got the a bullish Pinbar on sloping 8 EMA, target at 2740.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.