The recovery made at the end of the previous week has continued throughout the passing week, and except for Friday, we had a HH HL Daily bar for everyday, a very strong picture.

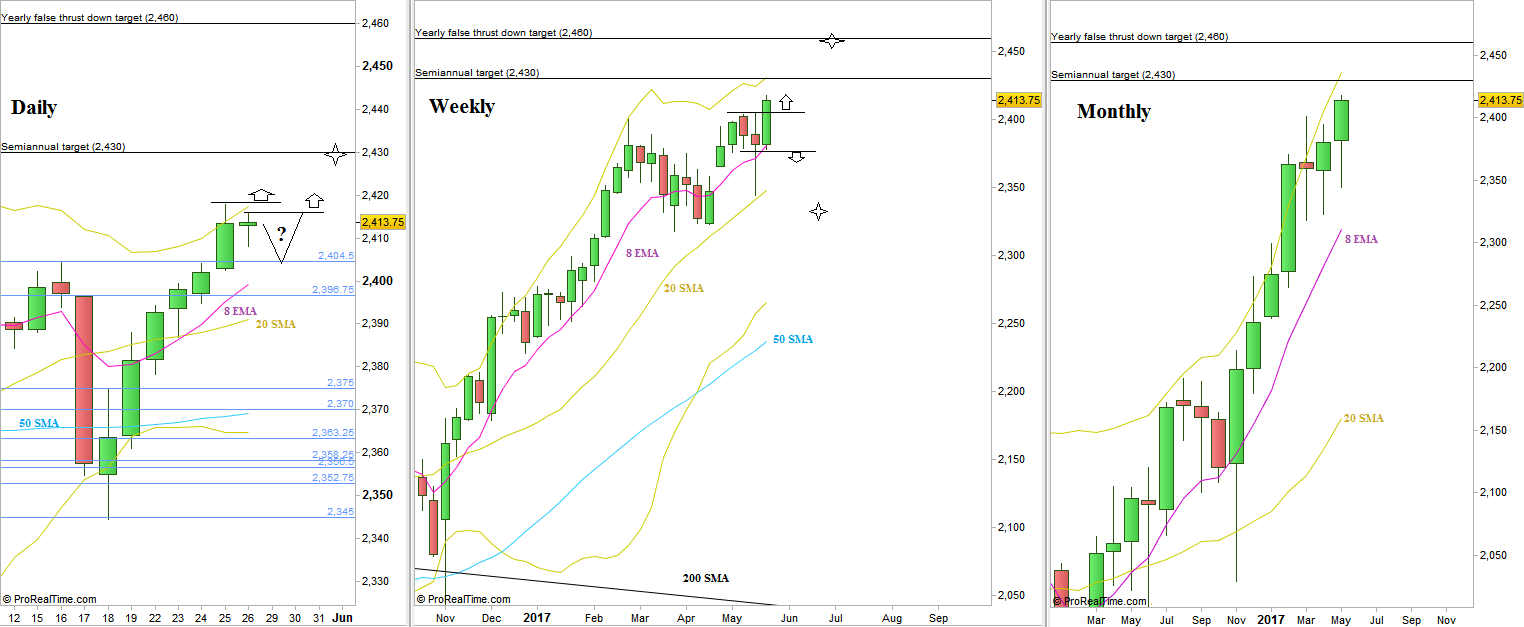

As mentioned in the previous review, taking out the Weekly bullish Pinbar’s High which was the all time High as well is a bullish setup to reach the area level of 2460. The market has triggered this setup last Thursday. The current Stop level for that is the Weekly Low, at 2378.25.

For the shorter term, two main bullish scenarios can emerge. One is that the market opens strongly taking out last Thursday’s High (all time High) in this case buy the break up with the Stop below last Friday’s Low. The second is to see first a thrust down that takes out the Low of last Friday at 2408 (inside bar), preferably respecting the Low of last Thursday, and then buy the market if/when last Friday’s High is going to be taken out. The target for both is the next major target – the Semiannual bullish Pinbar on sloping 8 EMA of the first half of the year 2016, with its mirror amplitude at 2430.

On the other hand, with very few chances, -taking out the Weekly Low at 2378.25 in this coming week is a clear sign of weakness and most likely going to deepen the decline down to 2340.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.